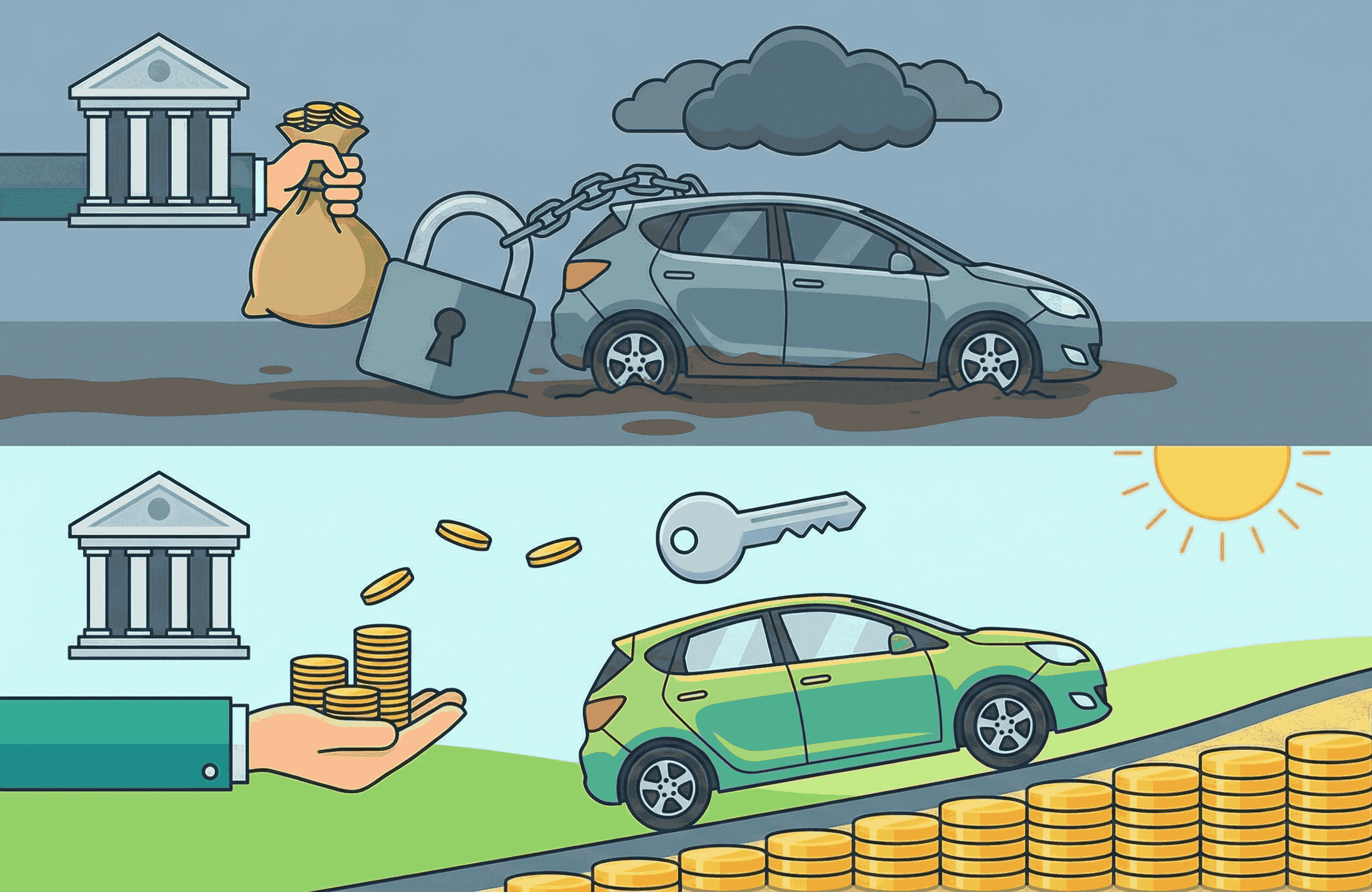

For decades, Malaysian car buyers had no choice: you took the Fixed/Flat Rate loan the bank gave you. But the landscape has changed. The new Reducing Balance loan is finally giving power back to the consumer.

If you are looking at a Perodua Ativa (RM 60,000), the difference between "the old way" and "the new way" is big, it's pretty much the difference between paying for a holiday or giving that money to the bank.

Here are the only three things you need to know about this new loan type: how much is actually the interest rate and amount, what happens if you settle the loan earlier, and how extra payments impact your loan. We’lll use that Perodua Ativa example with our Car Loan Calculator, using a RM 54,000 loan (90%) over 7 years as our guide.

1. Why 3% Was Never 3%: What is the Actual Interest?

The trickiest part about the old (Rule 78-based) loan is the claim to have a 3.00% interest rate. Our calculator helps you "see through" the sales talk by showing you the Effective Interest Rate (EIR) which is the rate you're actually paying.

You can see above that the actual interest rate you pay for the loan is a whopping 5.72%, whereas the new Reducing Balance loan is closer to the actual advertised amount.

The simple truth: The new Reducing Balance loan is much cheaper because you only pay interest on the money you still owe. In the old flat loans, the bank charges you interest on the full RM 54,000 even in your very last month of payment!

2. Selling Your Car Early? The New Loan Is Cheaper!

In the past, selling your car after a few years usually felt like a losing deal. That's because old loans use something called Rule 78, which makes sure the bank gets most of its interest profit from you right at the start. The new loan type makes things much fairer if you decide to sell after 5 years.

- Fixed/Flat Loan: You’d need RM 17,716 to settle the debt. Note: The Settlement Amount here assumes the bank is giving you the maximum amount, which may not happen.

- Reducing Balance Loan: You’d only need RM 16,601.

The win for you: With the Reducing Balance loan, you walk away with more cash in your pocket. Your monthly payments are actually doing the hard work of clearing your debt, not just lining the bank's pockets with interest.

3. Paying a Little Extra Now Makes an Impact.

The best part about the 2026 loan style is the freedom it gives you. If you get a bonus and want to knock off some of your debt (say RM 5,000 in Year 2 and RM 3,000 in Year 4) look at the difference:

- Fixed/Flat Loan: You save RM 0. The bank already "locked in" their profit, so paying early doesn't save you a cent in interest.

- Reducing Balance Loan: You save RM 1,205 in interest.

The win for you: For the first time, car owners get rewarded for being responsible. Every extra Ringgit you pay chops down your debt and cancels out future interest.

4. Tldr; Four Things to Remember

In short, the new reducing balance loan is much cheaper compared to the old Rule-78 based flat-rate loans. You can see that the Reducing Balance car loan (even with no extra payments) is RM5,404 cheaper compared to the Flat Rate car loan. In short, four takeaways to remember:

- Don't just look at the 3%: A 3% flat rate can have a much higher EIR.

- Reducing Balance is your friend: It’s the "honest" way to borrow, with a real rate of ~3%.

- Flat loans have a "Rule-78 memory": Flat rate loans lock in interest early. Reducing Balance loans stay flexible.

- You’re in control: Only the Reducing Balance loan lets you save money by paying off your car faster.

The easiest way to see how this works for your own budget is to try it out. Use our Car Loan Calculator to flip between flat and reducing modes or compare them directly. You'll see exactly how much you can save on your specific dream car.

5. Your 5-Minute "Deal-Checker" Action Plan

Buying a car is exciting, but don't let the paperwork overwhelm you. Before you sign on the dotted line, run through this quick 5-minute check to make sure you're getting the best deal possible:

- Ask the Right Question: Don't just ask about the interest rate. Ask the bank officer point-blank: "Is this a Reducing Balance loan or a Fixed/Flat loan?"

- Verify the "Real" Rate: Plug the offer into our Car Loan Calculator. Look for the EIR (Effective Interest Rate). If it jumps from a "3% deal" to over 5%, you’ve just spotted the old-style flat rate trap.

- Check the "True Fee": Look at the Total Interest amount. This is the actual fee the bank is charging you to borrow the money. See how much you pay monthly. Ask yourself: "Is this car still worth the price tag plus this extra fee?"

- Plan Your Exit: Use the Early Settlement feature in our tool. If you plan to sell the car in 5 years, will you owe the bank more than the car is worth? The new Reducing Balance loans help you avoid this "underwater" trap.

- Test Your "Bonus" Savings: If you think you'll have extra cash from a bonus or a raise in the future, see how much interest you can "kill" by making Extra Payments. Remember, this only works if you choose the Reducing Balance option!