How My "Boring" Investment Grew by 18.5% in 2025

If you kept your money in a standard Malaysian savings account last year, you likely earned about 2% to 3%. Meanwhile, my "boring" investment in VOO grew at a rate of 18.5% p.a.

I didn’t have to "trade" stocks, follow crypto signals, or spend hours on YouTube. I simply used a strategy that most people find dull, but the results were anything but. Here is exactly how I did it and why you should care about the difference between "asset performance" and "personal profit."

What exactly is VOO?

For those who are new to this, VOO is an Exchange Traded Fund (ETF) that tracks the S&P 500. This means when you buy one share of VOO, you are automatically investing in the 500 biggest companies in the US.

You are essentially betting on the success of global giants like Apple, Microsoft, Google, and Amazon. Instead of trying to find the "next big thing," you are buying the entire "winning team." It is simple, low-cost, and historically one of the most reliable ways to build wealth.

The Strategy: Dollar-Cost Averaging (DCA)

|

|

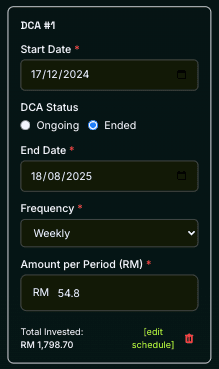

Figure 1: Visualization of my DCA strategy for 2025

I didn't start with RM 4,000. I built my savings week by week using Dollar-Cost Averaging (DCA), which is just a fancy term for investing a fixed amount on a regular schedule.

My method:

- DCA #1: I started by putting in RM 54.80 every week.

- DCA #2: Later in the year, I increased it to RM 199.03 every week.

By the end of 2025, I had invested a total of RM 4,187.05. Because the market was strong, my total value reached RM 4,514.20.

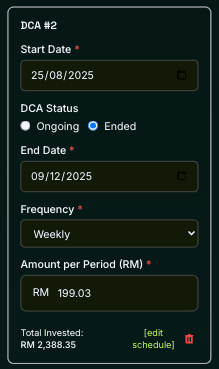

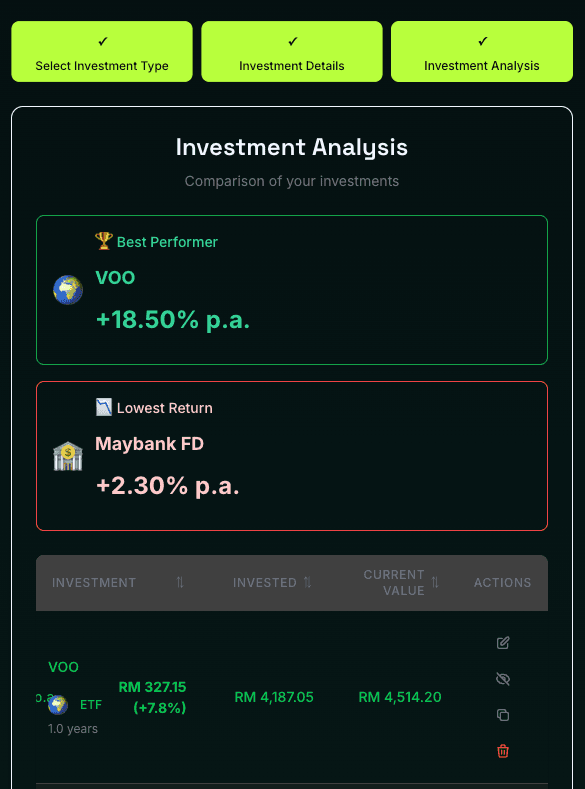

Why the 18.5% and 7.8% Numbers are Both Correct

If you look at my analysis, you will see a big +18.50% p.a. and a smaller +7.8%. It is important to understand this so you know how your money actually works in the real world.

- The 18.5% p.a. (The Speed of the Asset): This is the Per Annum (yearly) return. It tells you how much the S&P 500 grew from January to December. Comparing this to a Maybank Fixed Deposit (2.30% p.a.) shows you how much harder your money is working when it is invested in VOO.

- The 7.8% (The Progress of My Portfolio): This is my actual profit percentage for the year. Why is it different? Because I used DCA! My RM 199 deposits in December were only in the market for a few weeks. They haven't had the time to grow by the full 18.5% yet.

This is the beauty of DCA. It is an "entry ticket" for regular investors. You get to participate in a high-performance 18.5% growth environment without needing a huge lump sum on Day 1.

Stop Guessing: Compare Your Own Returns

Figure 2: Performance comparison between VOO and Maybank Fixed Deposit

I used the Investment Comparison Calculator to see how my regular DCA contributions impacted my bottom line. You can use this tool to:

- Find the true annualized return for each of your investments, including dividends.

- See side-by-side rankings to spot your best and worst performers.

- Benchmark your stocks against options like Fixed Deposits to see if the risk is actually worth it.

A Reality Check: The Ups and Downs

While 2025 was a fantastic year, the stock market does not always go up in a straight line.

Table 1: VOO Annual Total Returns (2020–2025)

| Year | VOO Annual Total Return |

|---|---|

| 2025 | +18.50% |

| 2024 | +26.26% |

| 2023 | +26.29% |

| 2022 | -18.11% |

| 2021 | +28.71% |

| 2020 | +18.40% |

If you started investing in 2022, you would have seen your account balance drop every month. This is why investing is a long-term game. The people who stayed consistent through the "Red" of 2022 are the ones who are smiling at the 18.5% returns of 2025 today.

Complexity is the Enemy of Consistency

One of the biggest myths is that investing needs to be complex to be successful. It doesn't. Whether you are using an ETF like VOO or local options like the Employees Provident Fund (EPF), the winning formula remains the same: DCA and Consistency.

Get started with EPF Auto-Simpan here to automate your future growth.

Why choose EPF?

- Safe Haven: It offers a guaranteed minimum return of 2.5%, though it has historically provided 5% to 6%.

- Compounding Power: Consistent top-ups in EPF benefit from compounding over time, but with significantly lower risk.

- Tax Relief: In Malaysia, your self-contributions can also qualify for tax relief, which acts as an immediate "return" on your money.

Regardless of the vehicle you choose, the goal is to stop waiting for the "perfect" time and start building the habit. Leverage the power of DCA to let your money work for you.

Hopefully, we all have a good year of investment growth, financially and in ourselves. All the best!